Indicators on Pvm Accounting You Should Know

Indicators on Pvm Accounting You Should Know

Blog Article

Everything about Pvm Accounting

Table of ContentsPvm Accounting Things To Know Before You Get ThisPvm Accounting Fundamentals ExplainedThe Ultimate Guide To Pvm AccountingThe Definitive Guide to Pvm AccountingExamine This Report on Pvm AccountingGetting My Pvm Accounting To WorkExamine This Report about Pvm AccountingPvm Accounting Things To Know Before You Buy

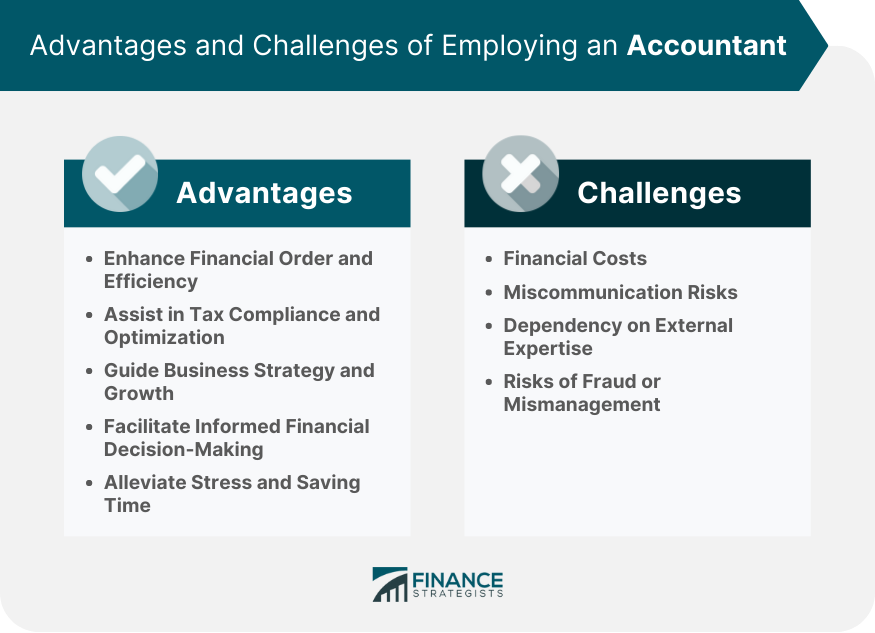

Running your service everyday can conveniently eat every one of your productive time as an entrepreneur. It can be frustrating to keep full oversight of your funds, specifically if your company is bigger than a one-person procedure. An excellent accounting professional will certainly aid you handle your endeavor's monetary declarations, maintain your publications tidy, and guarantee you have the regular positive capital or get on the roadway to attaining it.However we strictly guidance to people speak with a certified and expert financial consultant for any kind of sort of financial investment you require. We only discuss the investment and personal financing ideas for details and educational function right here. They can likewise aid educate you topics such as how to discover your financing cost on lendings to name a few topics

They have an eye for profits streams and can maintain the economic framework in mint problem. They do not have the same bias as pals or family members, and they are not linked with your firm the means staff members are. The distinction in between money and accounting is that accounting focuses on the day-to-day flow of money in and out of a company or institution, whereas finance is a broader term for the management of assets and liabilities and the planning of future development.

Pvm Accounting Can Be Fun For Everyone

You might not require to utilize an accountant for every one of your financial demands. You can employ an accountant throughout the start-up phase and have them manage your yearly reporting, yet deal with a bookkeeper to handle your books on a normal basis. An accounting professional can also aid business to monitor its economic performance and determine areas where it can enhance.

The requirements and treatments for becoming a Chartered Accounting professional vary relying on the certain professional body. It isn't called the gold handcuffs without excellent reason, and it's generally found in city/stockbrokers who get a high income extremely rapidly. They acquire the new residence, luxury car and take component in deluxe holidays.

Examine This Report on Pvm Accounting

As you can see, accounting professionals can assist you out throughout every stage of your firm's advancement. That doesn't indicate you have to employ one, but the ideal accountant must make life simpler for you, so you can concentrate on what you like doing. A CPA can help in taxes while likewise providing customers with non-tax solutions such as auditing and monetary advising.

Hiring an accountant minimizes the chance of declaring imprecise paperwork, it does not entirely remove the possibility of human error impacting the tax return. An individual accounting professional can aid you plan your retirement and likewise withdrawl.

The smart Trick of Pvm Accounting That Nobody is Talking About

An accounting professional is an expert who supervises the financial health of your organization, day in and day out. Every tiny service owner ought to consider working with an accounting professional before they actually require one.

An accounting professional is qualified to ensure that your firm abide by all tax regulations and company regulation, including complicated ones that service owners frequently forget. Whichever accountant you choose, see to it they can provide you a sense of what their history and capabilities are, and inquire exactly how they envision constructing a healthy economic future for your service.

The Greatest Guide To Pvm Accounting

Your accounting professional will certainly also offer you a feeling of necessary startup prices and financial investments and can show you just how to maintain functioning also in durations of reduced or unfavorable cash money flow.

6 Easy Facts About Pvm Accounting Shown

Running a small company can be a tough job, and there are several elements to track. Declaring tax obligations and taking care of funds can be specifically testing for local business proprietors, as it needs understanding of tax codes and monetary policies. This is where a CPA is available in. A Cpa (CPA) can offer vital assistance to small company owners and help them browse the intricate globe of financing.

: When it involves accounting, accounting, and financial planning, a certified public accountant has the expertise and experience to aid you make educated choices. This knowledge can save little company owners both money and time, as they can count on the CPA's knowledge to guarantee they are More Bonuses making the very best economic options for their service.

Certified public accountants are trained to remain current with tax obligation legislations and can prepare accurate and timely tax obligation returns. Clean-up accounting. This can save local business owners from frustrations down the line and guarantee they do not face any kind of fines or fines.: A CPA can also aid small company proprietors with monetary planning, which entails budgeting and projecting for future development

The Ultimate Guide To Pvm Accounting

: A CPA can additionally supply valuable understanding and evaluation for local business owners. They can assist identify areas where business is thriving and locations that require renovation. Armed with this details, tiny organization owners can make adjustments to their operations to optimize their profits.: Finally, hiring a CPA can offer small company proprietors with satisfaction.

Additionally, CPAs can provide guidance and support during financial crises, such as when the business faces unanticipated expenditures or an abrupt decline in earnings - construction accounting. Hiring a Certified public accountant for your tiny organization can supply many benefits.

Doing tax obligations is every honest person's obligation. The government won't have the funds to supply the solutions we all rely upon without our taxes. Because of this, every person is urged to arrange their taxes before the due date to ensure they avoid penalties. It's likewise suggested since you get advantages, such as returns.

The Definitive Guide to Pvm Accounting

The size of your income tax return relies on lots of aspects, including your earnings, reductions, and credit reports. Consequently, hiring an accounting professional is suggested because they can see everything to guarantee you get the optimum amount of cash. In spite of this, lots of people refuse to do so due to the fact that they believe it's nothing even more than an unnecessary expenditure.

When you employ an accounting professional, they can help you prevent these blunders and ensure you obtain one of the most money back from your income tax return. They have the knowledge and know-how to know what you're eligible for and just how to obtain the most cash back. Tax obligation period is typically a demanding time for any type of taxpayer, and for an excellent reason.

Report this page